We are an investment firm

targeting supply chain imbalances and driving innovation in México's credit, healthcare, and education sectors, poised for a transformative disruption.

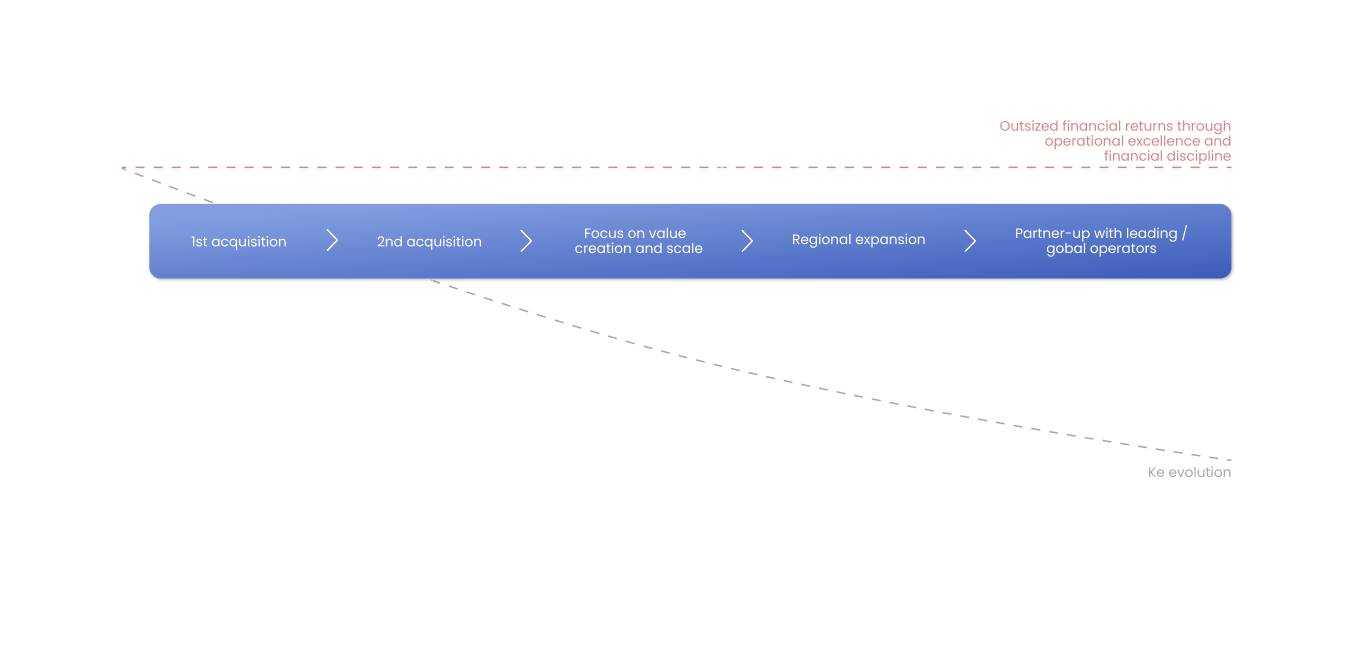

We aim to implement a long-term investment strategy in businesses that generate recurring cash flows:

High gross margin businesses in geographies with nearshoring opportunities in fragmented industries.

Long-term investment horizon, reinvesting cash flows to fund growth – bolt-on acquisitions and organic growth – and generate compounded returns.

Create value by supporting management teams, institutionalizing corporate structures and streamlining operations with technology.

Provide liquidity to investors

Recycling investor base to provide liquidity to investors on specific time windows.

Value proposition

Designed from first-hand experience and lessons learned in Private Equity investments in Mexico.

Strategic pillars

01

Unique deal sourcing capabilities – identify off-market transaction thanks to track-record, wide network and market understanding.

02

Maximize asset value – through financial engineering and enhancement of capital structures

03

Active management to reinforce operations – partner with management teams to improve performance

04

Solid track-record – allows us to lead transformative and accretive growth through strategic M&A supported by solid track-record

05

Provide liquidity to investors – reduce cost of equity and incremental funding alternatives

Marea vis-á-vis Traditional Private Equity

Management

Fees

Deal size /

# of deals

Holding

period

Capital

structure

Local currency

exposure

Annual budget to cover operating expenses and management salaries

$30-50M / 2 verticals

plus add-ons

Permanent capital with drawdowns every 5 years at decreasing NAV discount

Invests across the capital structure of companies to enhance cash-flow generation

+75% of underlying assets will generate USD denominated cash flows

Traditional

Private Equity

% over committed /

invested capital

$80-100M /

5-7 transactions

5-7 years

Focus on equity investments in illiquid assets

Mismatch between USD returns – hurdle and carry – and local currency generating assets

Management Fees

Annual budget to cover operating expenses and management salaries

Deal size / # of deals

$30-50M / 2 verticals

plus add-ons

Holding period

Permanent capital with drawdowns every 5 years at decreasing NAV discount

Capital structure

Invests across the capital structure of companies to enhance cash-flow generation

Local currency

exposure

+75% of underlying assets will generate USD denominated cash flows

Traditional Private Equity

Management Fees

% over committed /

invested capital

Deal size / # of deals

$80-100M /

5-7 transactions

Holding period

5-7 years

Capital structure

Focus on equity investments in illiquid assets

Local currency

exposure

Mismatch between USD returns – hurdle and carry – and local currency generating assets